阅读:0

听报道

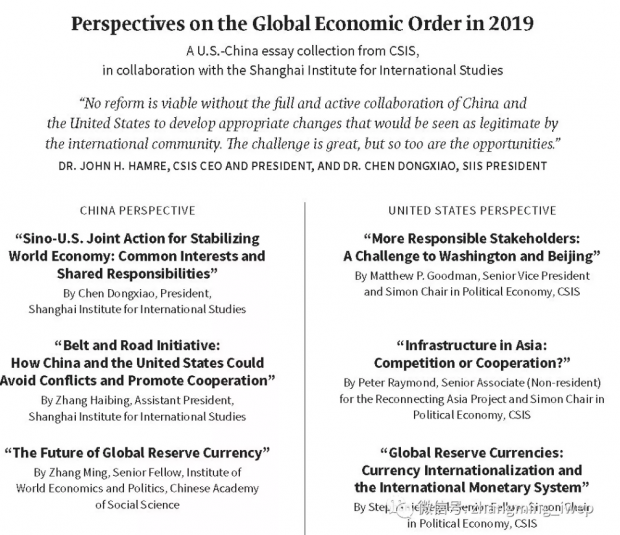

注:本文为美国战略与国际研究中心(Center for Strategic & International Studies,CSIS)与中国上海国际问题研究所(SIIS)合作的一个研究项目的成果之一。这个研究项目颇为有趣,是由六位美国学者与六位中国学者分别就六个问题展开论述,能够构成中美学者在特定问题上的直接对话。六个问题及作者的简介如下。笔者应邀为国际货币体系改革前景撰文。谢绝各类媒体转载。

After the collapse of the Breton Woods System, US Dollar played the role of global reserve currency. Before the breakout of US subprime crisis in 2008, the scholars and analysts were worrying about the global imbalance. As long as United States were facing persistent current account deficit and accumulating external debt, the creditor countries including China worried about the potential large depreciation of US Dollar, which could improve US’s external balance at the price of creditor countries’ capital loss.

The Fed began to carry out zero interest rate and quantitative easing (QE) policy after the burst of US subprime crisis. Interestingly, the USD did not depreciate significantly in the following decade after the crisis. One of the key factors supporting USD’s exchange rate was that the global economic growth had been persistently weak after the crisis, which had been named as secular stagnation. However, US’s ultra-loose monetary policy exacerbated the global excess liquidity. During that time, most emerging market countries faced massive capital inflow, fast local currency appreciation and rising asset prices.

However, after the recovery of US economy, the Fed started the monetary policy normalization. The Fed exited the QE program in the end of 2014, and hiked the Fed rate nine times from 2015 to 2018. During this time, many emerging market countries had to face large capital outflow, which pushed down both domestic asset prices and domestic currency’s exchange rate. To summarize, the emerging market world had to face the spill-over effects of US’s domestic monetary policy in both its expanding and contracting stages.

The story of US Dollar exposed the deep problems under the system in which a national currency played the role of global reserve currency. One problem was that, to satisfy the global demands for international liquidity, the Fed had to keep issuing large amount of US dollars. However, it would become more and more difficult for US government to stabilize the exchange rate of USD (This was exactly the problem before the US subprime crisis). In fact, this problem is a generalized form of Triffin dilemma. Moreover, United States had been motivated to issue more than enough USD to increase its own benefits. For example, the Fed could issue a larger amount of USD to pay the bills of real source imports, which constituted a form of seigniorage. This was an exorbitant privilege for USD, and other countries had to accept it.

Another problem was that, US’s domestic monetary policy would exert strong spill-over effects to other countries, because other countries did not want their own currencies to fluctuate violently against US Dollar. This could also explain why the Fed’s monetary policy moves would initiate global financial cycles.

The future global reserve currency must overcome the above-mentioned two problems of the current US Dollar dominating system. We expect that there might be a three-Polar global reserve currency regime in the future, under which US Dollar, Euro and Renminbi could all play the role of international reserve currency. The exchange rate between the above three central currencies should be floating, not fixing.

One of the major advantages of the multi-polar reserve currency system is that a new competing mechanism could be introduced to limit the over-issuing of certain reserve currency, which help to stabilize the purchasing power of this currency. For example, if US Dollar has been over-issued by the Fed to satisfy US’s domestic interests, the investors would exchange their holdings of US dollar assets into Euro or Renminbi denominating assets, which would result in the depreciation of US Dollar and the degrade of USD’s image as an international reserve currency. In other word, the introduction of other competitors could effectively limit the exorbitant privilege of a reserve currency issuing country.

The multi-polar reserve currency system should allow emerging market countries to manage the short-term capital flows if necessary, because this could help the emerging countries to mitigate the negative spill-overs from reserve currency countries. For example, if Vietnam’s economy is hot and is facing inflation pressure and European economy is facing a deep recession, to reduce the negative influences of the monetary policy loosing of European Central Bank, the Vietnam’s central bank could strengthen the capital-inflow management to resist potential hot money inflow. The freedom to introduce capital flow management could strengthen emerging market countries’ monetary policy independence.

However, whether a multi-polar global reserve currency system is more stable than a single reserve currency system has been under a long-term and hot debate. For example, when most investors begin to buy US Dollar and sell Euro at the same time, the exchange rate of USD against Euro would appreciate significantly, which might exert negative impacts to not only reserve currency issuing countries but also other countries. The frequent and massive fluctuations of exchange rate between global reserve currencies might dis-stabilize, not stabilize the global monetary system.

Maybe the use of a brand-new global reserve currency would become a better alternative. For example, if all countries agree to use the special drawing rights (SDR) as the new global reserve currency, this could not only overcome the problems of using national currency as global reserve currency, but also avoid the large exchange rate fluctuations between different reserve currencies. Moreover, if there is a new global central bank to issue new global reserve currency, it could use the seigniorage to better provide global public goods.

However, the creation and use of a new global currency would be much more difficult than the introduction of a multi-polar currency regime, because it would be very difficult to persuade a country to give up the right to issue domestic currency, especially for an already successful and influential currency.

It is very interesting that the evolvement of global reserve currency regime has always been driven by international crisis. Maybe in the future, a US dollar relating crisis would facilitate the transition from a US Dollar dominating regime into a multi-polar reserve currency system. And in the far future, a global financial crisis would push all countries to form a treaty to use a brand-new global reserve currency.

(Ming Zhang is a senior fellow in Institute of World Economic and Politics, Chinese Academy of Social Science. His email is .)

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号